schedule c tax form 2020

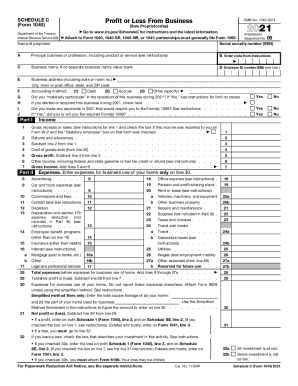

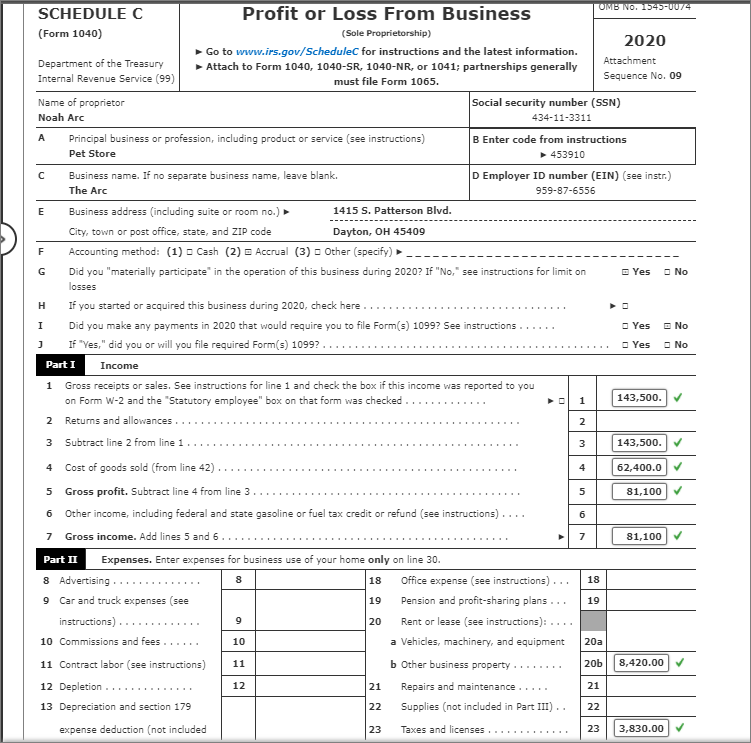

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. About Schedule C Form 1040 or 1040 SR Profit or Loss from 2020-2022.

Schedule C Fill Out And Sign Printable Pdf Template Signnow

98 rows Prior Year Products.

. If you are a resident alien use the 2019 Instructions for Forms 1040 and 1040-SR to help you complete Form 1040. The resulting profit or loss is typically. Printable Form 1040 Schedule C-EZ.

Schedule F Form 1040 to report profit or loss from. Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form. Include pictures crosses check and text boxes if needed.

Fill in if you. Shareholders Aggregate Foreign Earnings and Profits. 26 rows Form 965 Schedule C US.

Schedule F Form 1040 to report profit or loss from farming. Form 1040 due to the Taxpayer Certainty and. NCDOR Taxes Forms Sales and Use Tax Sales and Use Tax Forms and Certificates Tax Returns Schedules Form E-536 Schedule of County Sales and Use Taxes.

Check the correctness of filled details. Tax Forms Calculator for Tax Year 2020. 2020 irs form 1040 schedule c instructionsContinueSchedule C also known as Form 1040 Profit and Loss is a yearend tax form used to report income or loss from an individual entrepreneur.

Massachusetts Profit or Loss from Business. Select a category column heading in the drop down. Utilize the Sign Tool to create your distinctive signature for the file legalization.

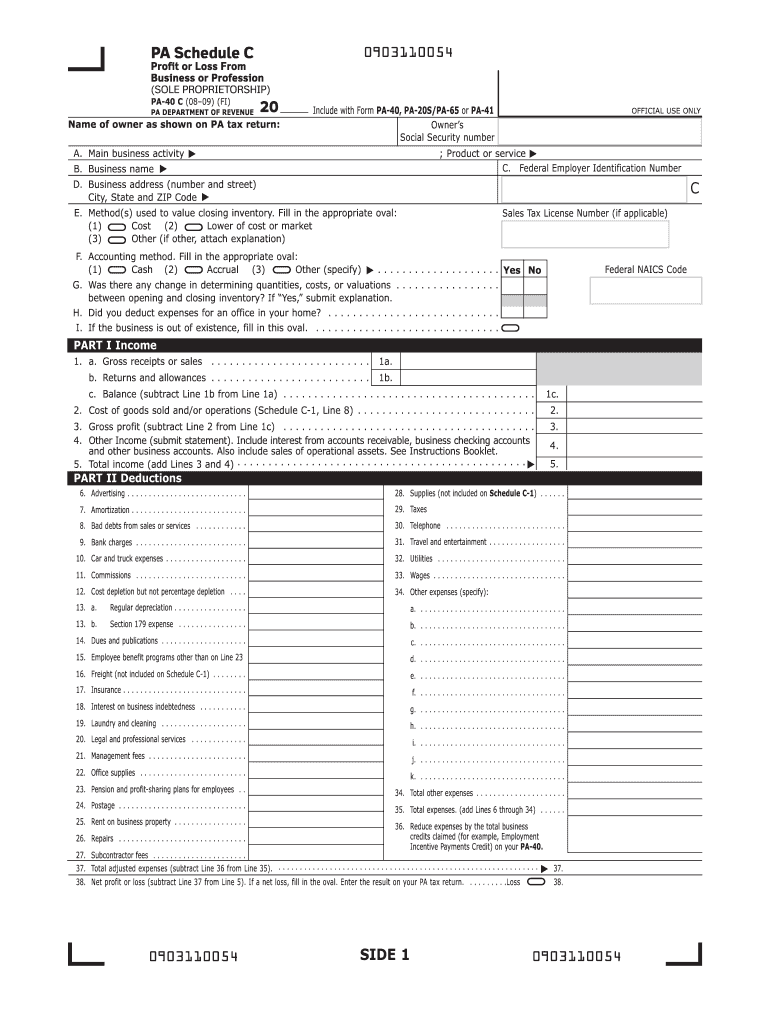

Click any of the IRS Schedule C-EZ form links below to download save view and print the file for the corresponding year. Fill in the details required in IRS 1040 - Schedule C using fillable fields. Use Schedule C-2 on Side 2 of this.

If using bonus depreciation do not use Form 4562. Schedule E Form 1040 to report rental real estate and royalty income or loss that is not subject to self-employment tax. Click on the product number.

The Schedule C form is generally published in October of each year by the IRS. Enter a term in the Find Box. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

SCHEDULE C- 2 - Depreciation Social Security Number. Schedule C instructions follow later usually by the end of. 2020 Tax Returns were able to.

Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. January 1 - December 31 2020. However the COVID-related Tax Relief.

Open the record with our advanced PDF editor. Fill in if you made any payments in 2020 that would require you to file Forms 1099. Name of owner as shown on PA tax return.

2019 Schedule C Instructions. Add the date of filling IRS 990 or 990-EZ - Schedule C. Nonresident Alien Income Tax Return to help you complete Form 1040-C.

Schedule E Form 1040 to report rental real estate and royalty income or loss that is not subject to self-employment tax. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. You may also need Form 4562 to claim depreciation or Form 8829 to.

IRS Income Tax Forms Schedules and Publications for Tax Year 2020.

2021 Schedule C Form And Instructions Form 1040

You Re Requesting That I Upload Tax Documents For My Application What Should I Provide Tax Form Examples Shown Applying For Loans Help Center

1099 Nec Conversion In 2020 Page 2

Solved Schedule C Profit Or Loss From Business Omb No 1545 0074 Form 1040 Or 1040 Sr Sole Proprietorship 2019 Go To Www Gov Schedulec For Inst Course Hero

Fillable Pa 40 Fill Out Sign Online Dochub

A S E F G H E No Oms No 1545 0074 Schedule C Profit Chegg Com

Business Activity Code For Taxes Fundsnet

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Tax Forms Irs Forms Irs Tax Forms

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

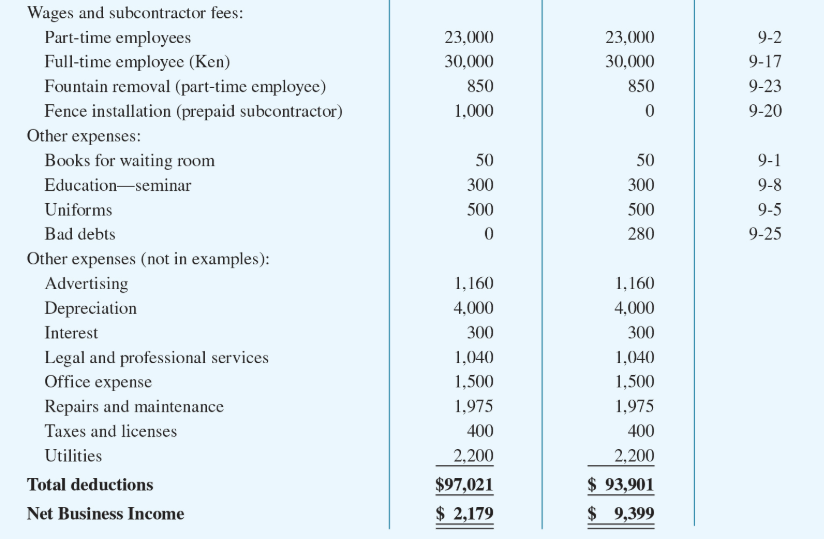

Schedule C Profit Or Loss From Business

![]()

Schedule C Instructions How To Fill Out Form 1040 Excel Capital

Solved Schedule C Profit Or Loss From Business Omb No 1545 0074 Form 1040 Or 1040 Sr Sole Proprietorship 2019 Go To Www Gov Schedulec For Inst Course Hero

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

Do You Have To Report A Ppp Loan On Your Taxes

How To Fill Out Schedule C For Business Taxes Youtube

1040 2021 Internal Revenue Service

Crypto Taxes Schedule D And 8949 Cryptocurrency Form 8949 And Schedule D Crypto Gains And Losses Youtube

Schedule C Worksheet Fill Out Sign Online Dochub

What Is An Irs Schedule C Form

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com